Tuesday, 24 March 2015

Monday, 16 March 2015

No proposals to increase working days to 6 per week: Govt

New Delhi: The government on Friday said it has no proposals to shift

to six-day week working for its offices or reduce the retirement age of

employees to 58 years.

"At present, there is no proposal to change working days for the

Central government offices from five to six days a week or to reduce the

retirement age of the Central government employees to 58 years,"

Finance Minister Arun Jaitley said in a written reply to the Lok Sabha.

At present, the retirement age of the Central government employees is 60 years.

The Minister also said that the Seventh Central Pay Commission

appointed in February 2014 is required to make its recommendations

within 18 months from the date of its constitution.

Former Supreme Court Justice Ashok Kumar Mathur is the Chairman of the Commission.

The government constitutes Pay Commission almost every ten years to

revise the pay scales of its employees and often these are adopted by

states after some modification.

The Sixth Pay Commission was implemented with effect from January 1, 2006

PTI

Source : http://zeenews.india.com

Government employees may get LTC to visit SAARC nations

Central government employees may get to

visit some SAARC nations barring Pakistan under new Leave Travel

Concession (LTC) rules being finalised by the Centre.

"Employees will be able to avail LTC to

visit some SAARC countries. A proposal in this regard is being finalised

by the government," Union Minister Jitendra Singh told .

LTC allows grant of leave and ticket reimbursement to eligible central government employees.

The decision has been taken to promote people-to-people contact and boost tourism among the SAARC regions, he said.

"The government has been taking many

steps to promote trade and travel. This is one of such steps to further

boost ties among SAARC nations," said Singh, Minister of State for

Personnel, Public Grievances and Pensions.

The South Asian Association for Regional

Cooperation (SAARC) is a group of eight nations comprising Bangladesh,

Bhutan, Maldives, Nepal, Pakistan, Sri Lanka, Afghanistan and India.

Officials in the Personnel Ministry said

the LTC facility will not be available for visiting Pakistan and few

other nations due to security concerns.

The draft for new LTC rules is in initial stage and it will be finalised after inter-ministerial consultations, they said.

"One of the major decisions taken by the

Narendra Modi government soon after it took over was to extend the

facility of conversion of 'home town' LTC to visit states of Jammu &

Kashmir, northeastern region and Union Territory of Andaman &

Nicobar for a further period of two years up to September 25, 2016," the

Minister said.

The Personnel Ministry has been

regularly reviewing LTC rules to allow government employees to visit

unexplored places like northeast. The ministry is also considering

allowing government servants not entitled to travel by air to fly in

economy class.

The ministry has of late put in place

measures to check misuse of LTC facility. CBI is probing fake travel

bills scam (LTC scam) allegedly involving certain government employees

and present and former Members of Parliament.

"All the ministries or departments are

advised to bring it to the notice of all their employees that any misuse

of LTC will be viewed seriously and the employees will be liable for

appropriate action under the rules.

"In order to keep a check on any kind of

misuse of LTC, ministries or departments are advised to randomly get

some of the air tickets submitted by the officials verified from the

airlines concerned with regard to the actual cost of air travel

vis-a-vis the cost indicated on the air tickets submitted by the

officials," according to an order issued by the Personnel Ministry.

Saturday, 14 March 2015

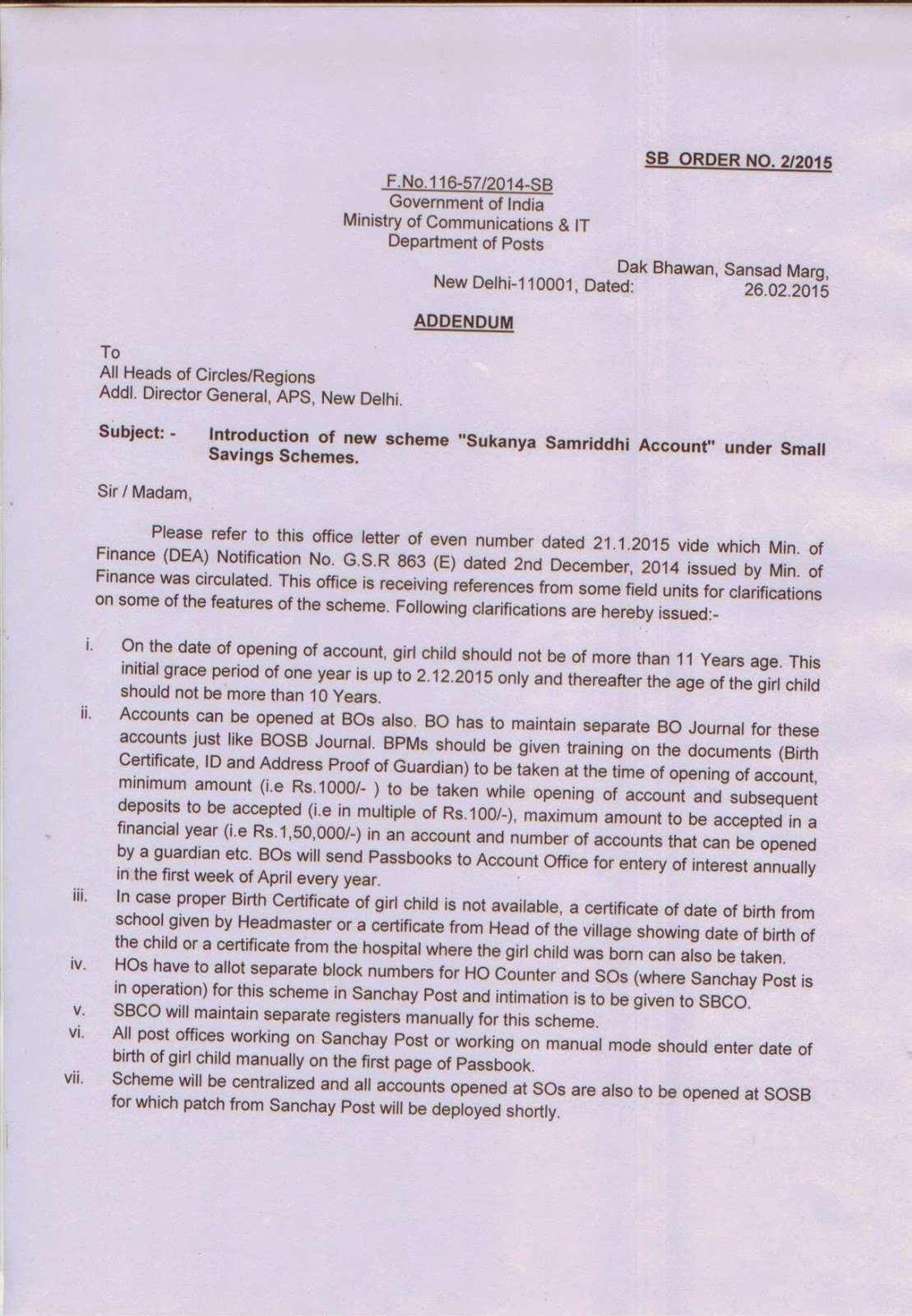

Inauguration of Sukanya Samriddhi Account Facilitation Center By Hon'ble PMG Indore Region at Datia MDG Gwalior Division Indore Region MP Circle on 12/03/2015

Sukanya

Samriddhi Account Facilitation Center has been inaugurated by Hon'ble

PMG Indore Region Shri A K Roy at Datia MDG Gwalior Division Indore

Region MP Circle on 12/03/2015 in presence of SPO's Gwalior Dn Shri A S

Rathore, SDI(P) Datia Sub Dn Shri V P Rathore, Post Master Gr-I Datia

MDG Shri Ravindra Sharma, SM Datia MDG R K Kushwah & all staff

members and Customers.

No proposal under consideration of the Government to curtail the public holidays for government employees

No Curtailing of Public Holidays

As per the existing policy, the Central Government Administrative

Offices observe up to 17 holidays in a year on specified occasions which

consist of 3 National Holidays (on 26th January, 15th August and 2nd

October) and 14 other holidays to celebrate festivals of different

regions/religion in a diverse country like India.

At present there is no proposal under consideration of the Government to curtail the public holidays for government employees.

This was stated by the Minister of State for Personnel, Public

Grievances and Pensions and Minister of State in Prime Minister’s office

Dr. Jitendra Singh in a written reply to a question by Shri S.

Thangavelu in the Rajya Sabha today.

Source : PIB News

Wednesday, 11 March 2015

Monday, 9 March 2015

PA/SA Exam for Madhya Pradesh Cancelled. Re-Exam on 15 and 22 March 2015

| Schedule of Re Examination (Paper I) for the following Postal Circles is as follows: | |||||||||||||

|

|||||||||||||

| Candidates may download Fresh Admit Cards for above stated Postal Circle by Logging into the website from today to the exam date. Please Note: Exam city for some candidates have been changed from that of last time. Please keep visiting the website for updates. | |||||||||||||

| Update as on March 04, 2015 | |||||||||||||

| Examination (Paper I) for Madhya Pradesh Postal Circle, held on June 22, 2014, has been cancelled. A Re-examination is being scheduled. Candidates, who appeared in the last Examination (Paper I) held on June 22, 2014, will only be called for the Re-examination. And Candidature of the candidates, who were reported involved in any malpractice, has been cancelled. Please keep visiting the website for exam schedules & updates. | |||||||||||||

Wednesday, 4 March 2015

EDITORIAL POSTAL CRUSADER MARCH 2015

MAKE THE 28th APRIL -2015 PARLIAMENT MARCH

ON THE CALL OF NATIONAL COUNCIL JCM

A HISTORIC SUCCESS.

The Central Government is reluctant to settle the justified and genuine demands of Central Government employees i.e. 100% D.A. merger, 25% Interim Relief, Inclusion of GDS in 7th CPC , Date of Effect 1.1.2014 , Scrapping of New Pension Scheme , filing up of vacant posts, in all Department’s , withdrawal of contractrization and out sourcing policy, removal of 5% ceiling on compassionate appointments, Removal of MACP related anomalies , Revision of OTA Rates including some other demands.

Joint Consultative Machinery which was formed for the redressal of grievances of Central Government Employees by negotiations has been made defunct and no meeting has been held after 2010. After constitution of 7th CPC the views of Staff Side N.C. JCM has not been taken into account. The Terms of Reference of 7th CPC were declared unilaterally and agreed draft of Terms of Reference submitted by Staff Side was not given cognizance. The Minister in P.M.O. Shri Jitendra Singh replied in response to the question raised by some MPs that Government is not going to grant 100% or 50% D.A. Merger , 25% Interim Relief and inclusion of GDS in 7th CPC.

In the back ground of all these developments a National Convention of all constituents of National Council JCM was convened in New Delhi on 11th December-2014. All the participants’ organizations vehemently opposed the policies of Central Government.

After detailed deliberations it was decided that a massive Parliament March will be organized in New Delhi on 28th April-2015 in which the date of Indefinite Strike will be declared. Intensive preparation campaign is going on. NJCA was formed at National level in which the top leaders of AIRF, NFIR, AIDEF, NDWF, Confederation, NFPE and FNPO are included. State JCAs have been formed in most of the circles and State conventions have also been held and wherever it has not been formed the state leadership has been asked to complete this work very soon.

It has been decided to mobilize five lakh Central Government Employees to participate in Parliament March. Accordingly quota has been fixed for Railways, Defence, Confederation and NFPE. Accordingly NFPE has also allotted quota to each affiliated union. Comrades, as we know that whatever we have achieved that is because of struggles only. The present government is functioning to give maximum benefit to the corporates and capitalists. It is not at all concerned about the working class. It started disinvestment in PSUs, Declared 100% FDI in Railway and 49 % FDI in Defence. The recommendations of Task Force Committee headed by TSR Subramaniam .are big danger for Deptt of Post which has paved the way of privatization through Corporatization.

Confederation of C.G.E&W and NFPE have given separate programmes of agitation which should be observed with great enthusiasm.

NFPE calls upon the entire Postal, RMS and GDS employees to make all the programmes a grand success and mobilize the maximum number employees, more than the quota allotted to each affiliated union to take part in the Parliament March on 28th April-2015 on call of National Council JCM to make it a historic success.

PRESS STATEMENT of CCGEW on BUDGET 2015

CONFEDERATION OF CENTRAL GOVT. EMPLOYEES & WORKERS

1st Floor, North Avenue PO Building, New Delhi – 110001

Website: www.confederationhq.blogspot.com

President Secretary General

K. K. N. Kutty M. Krishnan

09811048303 09447068125

Dated: 28th Feb. 2015.

PRESS STATEMENT.

Budget 2015-16.

The Budget of Modi Government for the year 2015-16 presented today to the Parliament by the Finance Minister, Shri. Arun Jaitley belied all expectations of the poor people who placed their faith in the BJP in the last general elections. It is without doubt an anti-poor and pro-rich Budget. The Corporate Tax has been slashed to please the giant multinational Corporate houses, who really are the rulers in most of the Countries of the world, including ours. The Government has foregone about 8300 crores of direct tax revenue. The burden has been put on to the shoulders of the common working people in the form of indirect taxes to the extent of more than 23000 crores mostly coming from the increased service tax kitty.

Except raising the transport allowance exemption from Rs. 800 to Rs. 1600 p.m which only benefits the higher segment of tax payers among the salaried class, no concession or tax reduction has been given to the wage earners.

By not raising the non-taxable maximum which was needed in view of the high level of inflation, Modi Government has not only squeezed the middle class but also amassed more tax revenue from those class of wage earners, who get dearness compensation. In the process Government continue to ignore several judgements to exempt DA from taxation as DA is considered as a receipt, compensatory in nature. The salaried class of tax payers was constantly demanding the re- introduction of deduction under section 16(1) of the I.T. Act which was in vogue years back. While retaining such concessession and deduction to all other segment of tax payers, the Government continue to penalise wage earners who are really the honest tax payers.

Allocation for every social welfare schemes which targets the deprived section of the society has been reduced in percentage terms, the largest reduction being in the ICDS programme. The tax concessions to the rich and corporate houses are of the order of 5.89 lakh crores. This apart, the wealth tax has been fully abolished.

The Budget 2015-16 has unambiguously declared the intention of the Modi Government to pursue the neo- liberal economic policies vigorously.

K.K.N.Kutty

President

Link pay of Government workers with productivity, recommends finance panel

Link pay of Government workers with productivity, recommends finance panel

By Surojit Gupta, TNN

Source : The Economic Times

The 14th Finance Commission has suggested linking pay with productivity with a focus on technology, skills and incentives, a move aimed at raising the productivity of government employees.

The panel has recommended that in future additional remuneration be linked to increase in productivity.

The Seventh Pay Commission is expected to submit its recommendations by August and it has been asked to look at the issue of raising productivity and improving the overall quality of public services in the country.

The Sixth Pay Commission had also said that steps should lead to improvement in the existing delivery mechanism by more delegation and de-layering and an emphasis on achieving quantifiable and concrete end results. Emphasis is to be on outcome rather than processes, it had said. The earlier Pay Commissions had also made several recommendations to enhance productivity and improve administration.

The 14th Finance Commission's recommendations assume significance at a time when the Narendra Modi government has focused its attention to improve the delivery of public services and is taking steps to use technology to improve efficiency.

The Union government has taken several steps to shore up the bureaucracy and has changed the way attendance is measured in government offices.

"Further we recommend that Pay Commissions be designated as Pay and Productivity Commissions with a clear mandate to recommend measures to improve productivity of an employee," said the 14th Finance Commission headed by former Reserve Bank of India Governor YV Reddy.

The Reddy panel said productivity per employee can be raised through the application of technology in public service delivery and in public assets created.

"Raising the skills of employees through training and capacity building also has a positive impact on productivity. The use of appropriate technology and associated skill development require incentives for employees to raise their individual productivities," the Reddy led panel said.

"A Pay Commission's first task, therefore, would be identify the right mix of technology and skills for different categories of employees. The next step would be to design suitable financial incentives linked to measureable performance," the panel said.

An internal study by the Commission showed that the expenditure on pay and allowances (excluding expenditure for Union territories) more than doubled for the period 2007-08 to 2012-13 from Rs 46,230 crore to Rs 1.08 lakh crore.

Source : The Economic Times

Small Savings Scheme at a glance

SL

|

NAME OF SCHEME

|

RATE OF INT FROM 01.04.2014

|

MATURITY PERIOD

|

LIMIT OF DEPOSIT

|

OTHER FACILITIES

| |

9

|

KISSAN VIKAS PATRA

|

Rs 1000 becomes

|

1201

|

After 2 Yr 6m upto 3 Yrs

|

NO LIMIT

|

TRANSFER, PLEDGE

AVAILABLE-DENOMINATIONS

1000, 5000, 10000,

50000 AVAILABLE

(Totally 100 Months )

|

1246

|

3Yr to 3Yr 6m

| |||||

1293

|

3Yr to 4Yr

| |||||

1341

|

4Yr to 4Yr 6m

| |||||

1391

|

4Yr 6m to 5Yr

| |||||

1443

|

5Yr to 5Yr 6m

| |||||

1497

|

5Yr 6m to 6Yr

| |||||

1553

|

6Yr to 6Yr 6m

| |||||

1611

|

6 Yr 6m to 7Yr

| |||||

1671

|

7 Yr to 7Yr 6m

| |||||

1733

|

7Yr 6m- to 8Yr

| |||||

1798

|

8 Yr to 4m

| |||||

2000

|

on or after 8Yr 4m

(totally 100 months )

| |||||

10

|

SUKANYA SAMRIDDHI

ACCOUNT

|

9.1% This Year

|

21 Yrs or marriage date

whichever is earlier ( marriage after 18th age)

|

minimum 1000

multiples of 100 maximum

1.5 lakhs per year

Deposit Upto 14 years only

|

Income Tax rebate

under 80(c ) allowed for deposit. ( Rebate on interest is expected to be announced.)

Deposit of minimum of Rs 1000 to be made each year for 14 years only. Girl child upto age of 10 Yrs are eligible to open a/c thro’ guardian

| |

Compiled by B.RAJASEKARAN APM , TIRUTURAIPOONDI TN 614713

Gmail, Yahoo, Live is Banned by Govt for Official Work

GMail Login: With increase in the cyber snooping on the Governments around the world, The Government of India had banned usage of GMail for Official work by the Govt. Staff to protect the users ( Govt. Staff) and Govt Data.

The email policy which is drafted by The Department of Electronics and Information Technology (DEITY) in October 2013 is implemented by the Government after taking the views from all the ministries.This policy is aimed to protect the sensitive data of Government.

NOW GMAIL LOGIN IS NOT POSSIBLE IN GOVT. OFFICES

GMail Banned in Govt Offices

The Government said in the notification that “The e-mail services provided by other service providers shall not be used for any official communication,” .This decision is took by Central Government and will be followed by both government employees of both central government and state government including the UT also.

This policy strictly says that no Government employee should use the Gmail login or any other foreign E-Mail accounts like Yahoo mail, HotMail for the official work by the staff, And the staff should use the E-Mail services provided by only NIC.

Due to this policy all the government data shall be passing from the Government Servers covering nearly 5-6 lakh Central and State government employees.

And the notification also says that NIC will be Monitoring the activities of the staff and have the power to access the access, review, copy or delete any files on the server of any users (Govt. Staff) for security reasons.

‘Go India’ Smart Card for Train Tickets

‘Go-India’ smart card scheme has been launched on pilot basis on two sectors i.e. New Delhi-Mumbai and New Delhi-Howrah. At present, the Go-India smart card enables passengers to pay for reserved and unreserved tickets. The smart card can be used at nominated Unreserved Ticketing System (UTS)/Passenger Reservation System (PRS) counters and at Automatic Ticket Vending Machines (ATVMs) on these two sectors for issuing tickets. The salient features of the Go-India smart card are as under:

Initially, the card can be get issued by paying minimum Rs.70/- where passenger will get Rs.20/- balance.After that, card can be recharged for Rs.20/- or in multiple of Rs.50/- upto Rs. 5000/-.

Maximum limit on Go-India smart card is Rs.10,000/-.

Initially, the card can be get issued by paying minimum Rs.70/- where passenger will get Rs.20/- balance.After that, card can be recharged for Rs.20/- or in multiple of Rs.50/- upto Rs. 5000/-.

Maximum limit on Go-India smart card is Rs.10,000/-.

Go-India smart card has life time validity. In case of no usage in six months from the date of last transaction, smart card will be temporarily deactivated which can be activated again by paying Rs.50/- as activation fee.

The scheme is intended to reduce the transaction time at the booking counters for the convenience of passengers as it facilitates cashless transaction.

This information was given by the Minister of State for Railways Shri Manoj Sinha in written reply to a question in Lok Sabha today.

Seventh Pay Commission likely to submit report in October 2015

After 14th Finance Commission, 7th pay panel’s report looms : LiveMint

Read at: http://www.livemint.com

Finance ministry fears that its revenue will be affected in 2016-17 as it has to absorb new pay panel recommendations

New Delhi: After the recommendations of the Fourteenth Finance Commission (FFC) forced the government to reduce its plan expenditure in the 2015-16 budget, the Union finance ministry fears its revenues will remain constrained in 2016-17 as well since it has to absorb the recommendations of the Seventh Pay Commission (SPC) in that year.

The Seventh Pay Commission will submit its report by October 2015.

Click here for details of provision for 7th CPC in union Budget -2015-16

“The 7th Pay Commission impact may have to be absorbed in 2016-17. The phase of consolidation, extended by one year, will also be spanning out in this period. Thus, in the medium-term framework, the fiscal position will continue to be stressed,” the finance ministry said in the macroeconomic framework statement laid before Parliament along with the budget on Saturday.

The government appointed the Seventh Pay Commission on 28 February 2014 under chairman justice Ashok Kumar Mathur with a timeline of 18 months to make its recommendations. Though the deadline for submitting the report ends in August this year, the Seventh Pay Commission is likely to seek extension till October.

The Sixth Pay Commission which was constituted in October 2006 had submitted its report in March 2008.

As a result of the recommendations of the Sixth Pay Commission, pay and allowances of the Union government employees more than doubled between 2007-08 and 2011-12—from Rs.74,647 crore to Rs.166,792 crore, according to the Fourteenth Finance Commission estimates.

“As a ratio of GDP, it jumped from a little over 0.9% in 2007-08 to 1.2% in 2008-09 and about 1.4% in 2009-10 on account of both pay revision and payment of arrears. However, it moderated to little over 1% in 2012-13,” the Finance Commission said.

The recommendations of the Sixth Pay Commission were implemented by states with a delay mainly between 2009-10 and 2011-12, with “significant expenditure outgo” in arrears on both pay and pension counts, the FFC said.

The FFC said that while the finance ministry projects an increase in pension payments by 8.7% in 2015-16, a 30% increase is expected in 2016-17 on account of the impact of the Seventh Pay Commission, followed by an annual growth rate of 8% in subsequent years.

However, it maintained that given the variations across states and the lack of knowledge about the probable design and quantum of award of the Seventh Pay Commission, it is neither feasible, nor practicable, to arrive at any reasonable forecast of the impact of the pay revision on the Union government or the states. “Further, any attempt to fix a number in this regard, within the ambit of our recommendations, carries the unavoidable risk of raising undue expectations,” added the Finance Commission.

A senior Pay Commission official, speaking under condition of anonymity, said its recommendations will surely have significant impact on the revenues of the central government. “The 14th Finance Commission was at a disadvantage since it did not have the benefit of the recommendations of the Pay Commission unlike its predecessors,” he added.

N.R. Bhanumurthy, professor at the National Institute of Public Finance and Policy, said the FFC has tried to factor in the impact of the recommendations of the SPC on the central government expenses. “The FFC report shows the capital outlay of the central government will dip in 2016-17 to 1.4% of GDP from 1.64% a year ago due to the implementation of the Pay Commission recommendation before it starts rising to 2.9% of GDP by 2019-20,” he added.

The FFC said that all states had asked it to provide a cushion for the pay revision likely during the award period. The FFC advocated for a consultative mechanism between the centre and states, through a forum such as the Inter-State Council, to evolve a national policy for salaries and emoluments.

The FFC also recommended that pay commissions be designated as Pay and Productivity Commissions, with a clear mandate to recommend measures to improve productivity of employees, in conjunction with pay revisions. “We recommend the linking of pay with productivity, with a simultaneous focus on technology, skills and incentives. We urge that, in future, additional remuneration be linked to increase in productivity,” it said.

The Pay Commission official quoted earlier said it has been mandated to recommend incentive schemes to reward excellence in productivity, performance and integrity, which it will do. “Though previous Pay Commissions have talked about linking pay with productivity, the earlier governments have not accepted such recommendations. Since this government has shown strong political will, we hope they will accept our recommendations,” he added.

Read at: http://www.livemint.com

Sukanya Samriddhi Scheme: Income Tax Benefits And Other Features

The Sukanya Samriddhi Scheme has got tax-free status on interest income and withdrawal in the Budget. "Investments in Sukanya Samriddhi Scheme is already eligible for deduction under Section 80C. All payments to the beneficiaries including interest payment on deposit will also be fully exempt," Finance Minister Arun Jaitley said in his Budget Speech.

Sukanya Samriddhi Scheme is a small savings scheme which was launched in January this year and is aimed at encouraging savings for a girl child's education and marriage.

Taxation: A contribution of up to Rs. 1.5 lakh qualifies for income tax deduction under Section 80C of Income Tax Act. The clarifications in the Budget now make it clear that the entire maturity amount of the Sukanya Samriddhi Scheme and the interest earned are non-taxable, says Suresh Sadagopan, the founder of Ladder 7 Financial Advisories. In terms of tax treatment, it is on the lines of Public Provident Fund which also qualifies for Section 80C benefits, he says. Mr Ramesh says Sukanya Samriddhi Scheme is a good investment option to save for a girl child's future needs because the maturity amount is tax-free in the hands of the girl child. When the scheme was launched earlier this year, it was not clarified whether the withdrawal as well as interest would be exempted from tax.

Opening of account: The account may be opened by the guardian in the name of a girl child till she attains the age of ten years. Only one account is allowed per girl child. Parents can open this account for a maximum of two children. In case of twins or triplets, this facility will be extended to the third child. Account can be opened in post offices or authorized bank branches.

Age: The maximum age limit of the girl child for opening this account is 10 years. This year, a one-year relaxation has also been given.

Maturity: The account can be closed after the girl child in whose name the account was opened completes the age of 21. If account is not closed after maturity, the balance will continue to earn interest as specified for the scheme from time to time.

Withdrawal: Up to 50 per cent of the accumulated amount can be withdrawn after the account holder turns 18.

Interest rate: The government will every year declare the interest rate of the scheme. For 2014-15, the government would be paying 9.1 per cent interest. In comparison, PPF pays 8.7 per cent for 8.7 per cent interest in 2014-15.

Transferability: The account may be transferred anywhere in India if the girl child shifts to a place other than the city or locality where the account stands.

Deposits: The account may be opened with an initial deposit of Rs. 1,000 and thereafter any amount in multiple of Rs. 100 can be deposited. The minimum deposit for a financial year is Rs. 1,000 and maximum Rs. 1.5 lakh. Deposits in an account can be made till completion of fourteen years, from the date of opening of the account.

Penalty: An account where minimum amount has not been deposited in a particular year will attract a fine of Rs. 50 per year.

Operation of account: The account will be opened and operated by the guardian of a girl child till the girl child, in whose name the account has been opened, attains the age of 10 years. On attaining age of 10 years, the girl child may herself operate the account.

Source : NDTV

Subscribe to:

Comments (Atom)